FCL OFFICIAL ASSESSMENT CENTRE

How can you prepare for an assessment centre?

Well...

This programme is designed to provide both non-law and law students with a platform to test their Legal Commercial Awareness in a 'mock' assessment centre.

Each session will see the attendees presented with an interactive case study scenario. With this, you will be provided with a given set of facts which you will be expected to digest in order to provide answers to the given tasks at hand.

Each case study scenario will encompass a different financial or commercial focus, and a different context. This ensures that by the end of the programme you have been tested on a wide variety of commercial awareness topics.

Your answers provided to the tasks will be scrutinised by our founder, Mr. Denis Viskovich within an open panel - this will provide you with a fruitful opportunity to attain instantaneous and robust feedback.

After all...you want to make mistake with us and not in your vacation scheme or training contract assessment centre.

This programme will run from 19 October till 23 November 2021 (Specific timings below).

You can purchase all 6 sessions as a bundle (£89.99) or pick and choose which session you would to attend by purchasing individually (£19.99).

THE ASSESSMENT CENTRES

ASSESSMENT CENTRE 1

19 OCTOBER 2021

18:00 - 20:00

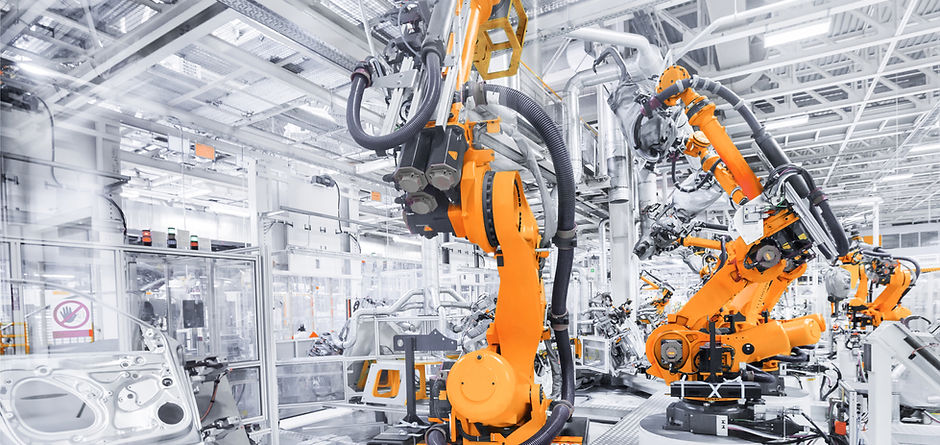

Speeding into China - An Analysis of International Expansion and Debt Finance

This session will test and develop your analytical skills as you advise directors of a British manufacturing company on how to internationally expand into China, and how to fund this expansion.

You will then interpret various legal and commercial facts and issues before completing a SWOT analysis of international market expansion, and the various financial options available.

Upon deciding the best course of action, you will lastly present your preferred strategy to the board of directors before receiving feedback on this advice.

ASSESSMENT CENTRE 2

26 OCTOBER 2021

18:00 - 20:00

Expanding Beyond the Horizon: The Dilemma Between Debt and Equity Financing

Although the Magnervirus pandemic and national lockdowns implemented by governments worldwide has halted global production, impacting the profits of all industrial companies, the CEO and founder of The People’s Glass (TPG), a Hong Kong listed Chinese company, is adamant about expanding its company into the United States by opening a brand-new factory there.

However, there is much debate within the company about which type of financing the company should adopt: debt or equity.

You have been approached as their external counsel to explain to them the benefits and detriments of these two types of financing. Next, you will also have an opportunity to ask their internal counsel for greater clarity on certain information they have provided to you.

Finally, they have asked that you provide them a recommendation as to the form of debt or equity financing that they should adopt and for you to give them the reasoning as to why.

ASSESSMENT CENTRE 3

2 NOVEMBER 2021

18:00 - 20:00

The chemistry of merging: evaluating a potential merger and how city law firms market and win business.

When two chemical giants collide through a merger, it will be up to you to provide extensive advice to ensure the business structures merge successfully, so that the new entity will stay ahead of the competition and satisfy their shareholders’ expectations.

You will be responsible for assessing various considerations; such as potential growth and run-rate cost synergies, competition law regulations and various financial pressures to ultimately decide whether the merger should take place.

Lastly, you will look through the lenses of a City Law Firm - and be asked to spot opportunities to market your legal services to the companies merging, and identify what legal departments of the City Law firm will be involved in the potential merger.

ASSESSMENT CENTRE 4

9 NOVEMBER 2021

18:00 - 20:00

A New Opportunity? How the retail sector remains competitive in the post COVID-19 era.

Since the COVID-19 hit the world in early 2020, we have seen rapid growth and resilience in the retail sector. Last year was a transformational year for the retail industry.

In this session, you will advise Montana (a rising star retail company aggressively aiming to expand its market presence and product portfolio) on acquiring Taya’s (a large chain of department store specialising in clothes and household products).

When Taya’s shareholders become disgruntled and choose to enact various defensive takeover strategies - it will be up to you to provide a commercial strategy for Montana to ensure the takeover is a success.

Finally, you will evaluate how exactly the transaction is to be financed and what financing options are available to Montana to complete the acquisition.

ASSESSMENT CENTRE 5

16 NOVEMBER 2021

18:00 - 20:00

Dissecting Private Equity: The complications of ‘buying-out’ a commercial Space company

When the management of an ambitious British space company becomes divided on the future of a rocket prototype, a Management-Buy-Out is implemented to push the business forward - or will it?

You will actively engage in evaluating the risks the space company may incur when faced with successfully carrying out the Management-Buy-Out. Next, you will consider possible mitigation strategies of the said risks, in order to ensure the determined management attempts to commercialise international space travel.

However, you will also fast-forward in the future and, if the buy-out is a success then you will carefully evaluate the options available to the Private Equity Fund in their hope of securing a lucrative exit strategy. This will involve careful assessment of an IPO, LBO, SPAC or even the notion of not selling - you will decide.

ASSESSMENT CENTRE 6

23 NOVEMBER 2021

18:00 - 20:00

Acquire to Survive: How to Stay Afloat as a Fintech Company

Fintech adoption has seen rapid growth. When COVID-19 wreaked havoc, fintech became a key sector for companies aiming to stay afloat. They enabled the rapid migration to digital payments at a time where lockdowns and social distancing hampered brick-and-mortar operations. But beyond the pandemic, the industry will inevitably be about survival.

One of these companies scrambling to maintain its position in the market is your client: DigiPay. DigiPay is a payments company aggressively seeking to expand its company portfolio by acquiring a 'buy now, pay later' (BNPL) provider.

Two promising BNPL providers have piqued DigiPay's interest: DelayToday Limited and FutureCash Limited.

As a Junior Consultant at DigiPay, you will carefully examine which company would better help DigiPay with its goals of expanding into the BNPL space. To do so, you will identify the risks and opportunities of acquiring both companies through a SWOT analysis on each company, and provide reasons for their decision to their client.